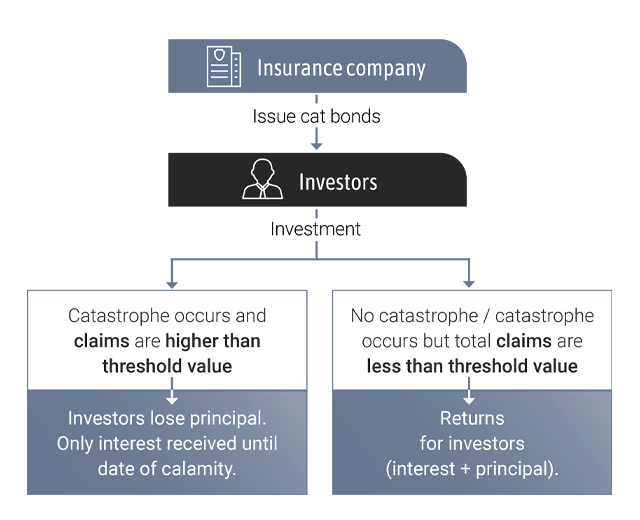

How cat bonds work

Catastrophe (cat) bonds, a type of insurance-linked security, provide capital to insurers and reinsurers in exchange for returns.

These bonds offer investors direct exposure to insurance risks, primarily for severe natural catastrophe events such as hurricanes, floods, and earthquakes.

Cat bonds are designed to raise money for insurance companies in the event of a natural disaster. The issuer receives funding under specific conditions, typically when a natural catastrophe occurs. If a qualifying event happens, the bond provides a payout to the insurance company.

They are typically sold to capital market investors, offering attractive interest rates in exchange for assuming the risk of a catastrophic loss. If a covered event occurs, investors may lose some or all of their investment, while the bond issuer receives the funds needed to cover their losses.

Why invest in cat bonds

A highly appealing aspect of cat bonds is that they typically have a low correlation to traditional markets. The likelihood of an insurable event, such as a hurricane or flood occurring, has little correlation to broader market conditions.

Cat bonds also offer several other compelling benefits, including:

- Access to pure insurance risk: investors gain exposure to pure insurance risk through cat bonds and private reinsurance placements.

- Diversification: cat bonds have a low correlation with traditional financial markets, providing effective diversification.

- Performance: historically, cat bonds have offered consistent returns with lower volatility compared to equities and other asset classes.

- Low interest rate sensitivity: cat bonds are less affected by interest rate fluctuations with little interest rate duration risk, making them resilient across economic environments.

- Rising reinsurance premiums: since 2017, reinsurance premium rates have increased by +100%, enhancing the attractiveness of cat bonds.

FAQs

- What distinguishes cat bonds from other ILS?

Cat bonds are liquid and generally provide protection higher up the risk tower, focusing on major catastrophic events, such as earthquakes and hurricanes. Other ILS may cover a broader range of risks or lower layers of risk.

- How are cat bonds structured to manage risk?

Cat bonds use a collateral trust account to back their payouts. In the event of a catastrophe, the collateral is used to pay claims, mitigating the risk for investors.

- How do cat bonds handle interest rate and inflation risks?

Cat bonds feature floating rates tied to money market funds, which helps mitigate interest rate and inflation risks. Their short tenors also allow for frequent repricing and risk re-evaluation.

- What should investors know about the risks associated with cat bonds?

While cat bonds offer strong returns and diversification benefits, they are exposed to risks from major catastrophic events. Additionally, fees and cash drag can impact performance.

- How can an allocation of cat bonds and private placements provide further diversification?

A highly appealing aspect of cat bonds is that they typically have a low correlation to traditional markets. The likelihood of an insurable event such as a hurricane or flood occurring has no correlation to broader market conditions.

- Is it still a good environment for investing in ILS?

As with all markets, the cat bond and wider private placement reinsurance markets are largely driven by a supply and demand of capital. The market has seen an impact on the supply-demand gap as the continually increasing demand for protection from reinsurers has outpaced the supply of capital (which was at times reducing), influenced by a number of factors, including inflation, which has driven an increased demand for reinsurance due to the higher costs of material and labour.